How To Find Direct Labor And Manufacturing Overhead Applied

ii.3 Assigning Manufacturing Overhead Costs to Jobs

Learning Objective

- Sympathise how manufacturing overhead costs are assigned to jobs.

Question: We have discussed how to assign direct material and direct labor costs to jobs using a materials requisition course, timesheet, and job price sheet. The third manufacturing cost—manufacturing overhead—requires a little more work. How practice companies assign manufacturing overhead costs, such as mill rent and factory utilities, to individual jobs?

Answer: Think from Affiliate i "What Is Managerial Accounting?" that manufacturing overhead consists of all costs related to the production process other than straight materials and direct labor. Because manufacturing overhead costs are difficult to trace to specific jobs, the amount allocated to each job is based on an estimate. The process of creating this estimate requires the calculation of a predetermined rate.

Using a Predetermined Overhead Charge per unit

The goal is to classify manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. The activity used to allocate manufacturing overhead costs to jobs is called an allocation baseThe activity used to allocate manufacturing overhead costs to jobs. . Once the allotment base is selected, a predetermined overhead rate tin exist established. The predetermined overhead rateA rate established prior to the twelvemonth in which it is used in allocating manufacturing overhead costs to jobs. is calculated prior to the year in which it is used in allocating manufacturing overhead costs to jobs.

Calculating the Predetermined Overhead Rate

Question: How is the predetermined overhead rate calculated?

Reply: Nosotros calculate the predetermined overhead rate as follows, using estimates for the coming twelvemonth:

Central Equation

*The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. Custom Article of furniture Company estimates annual overhead costs to be $ane,140,000 based on bodily overhead costs last year.

**The denominator requires an judge of activity in the resource allotment base for the year. Custom Piece of furniture uses direct labor hours every bit the allotment base of operations and expects its direct labor workforce to record 38,000 direct labor hours for the year.

The predetermined overhead rate calculation for Custom Furniture is as follows:

Thus each job will be assigned $30 in overhead costs for every directly labor hour charged to the job. The assignment of overhead costs to jobs based on a predetermined overhead rate is called overhead appliedThe assignment of overhead costs to jobs based on a predetermined overhead rate. . Remember that overhead practical does not correspond actual overhead costs incurred by the job—nor does it represent straight labor or straight textile costs. Instead, overhead applied represents a portion of estimated overhead costs that is assigned to a particular job.

Question: At present that nosotros know how to summate the predetermined overhead charge per unit, the next pace is to use this rate to employ overhead to jobs. How practise companies use the predetermined overhead rate to apply overhead to jobs, and how is this information recorded in the general journal?

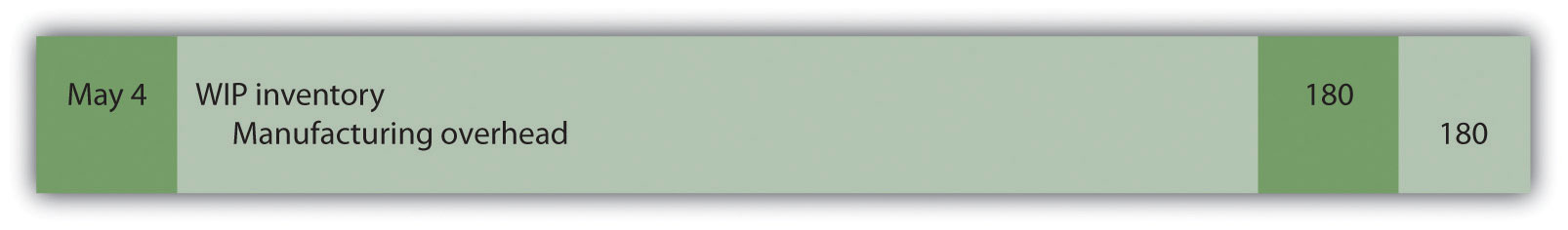

Answer: As shown on the timesheet in Effigy ii.4 "Timesheet for Custom Furniture Company", Tim Wallace charged six hours to job l. Because manufacturing overhead is applied at a rate of $xxx per directly labor 60 minutes, $180 (= $xxx × 6 hours) in overhead is practical to task 50. The journal entry to reflect this is as follows:

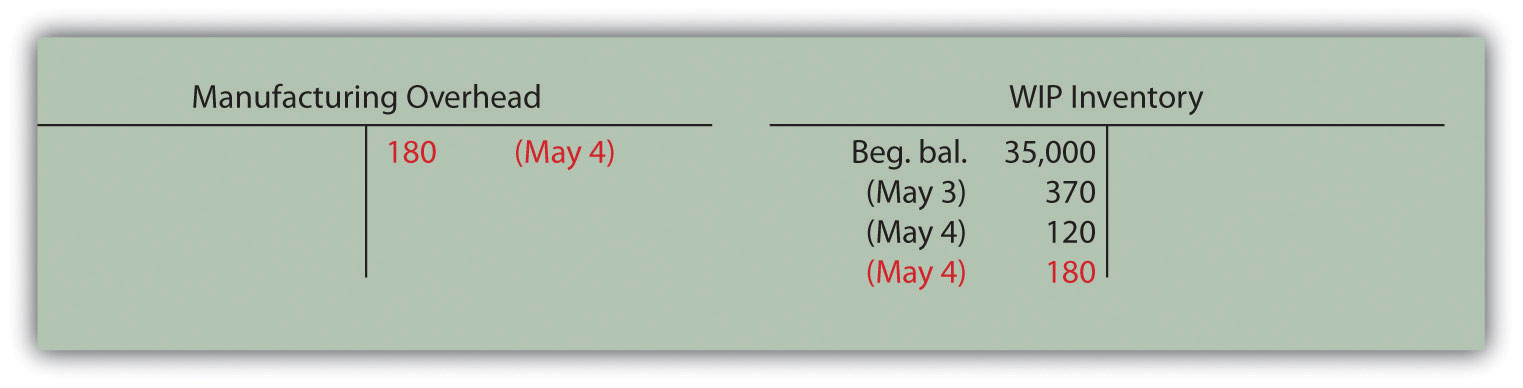

Recording the awarding of overhead costs to a chore is further illustrated in the T-accounts that follow.

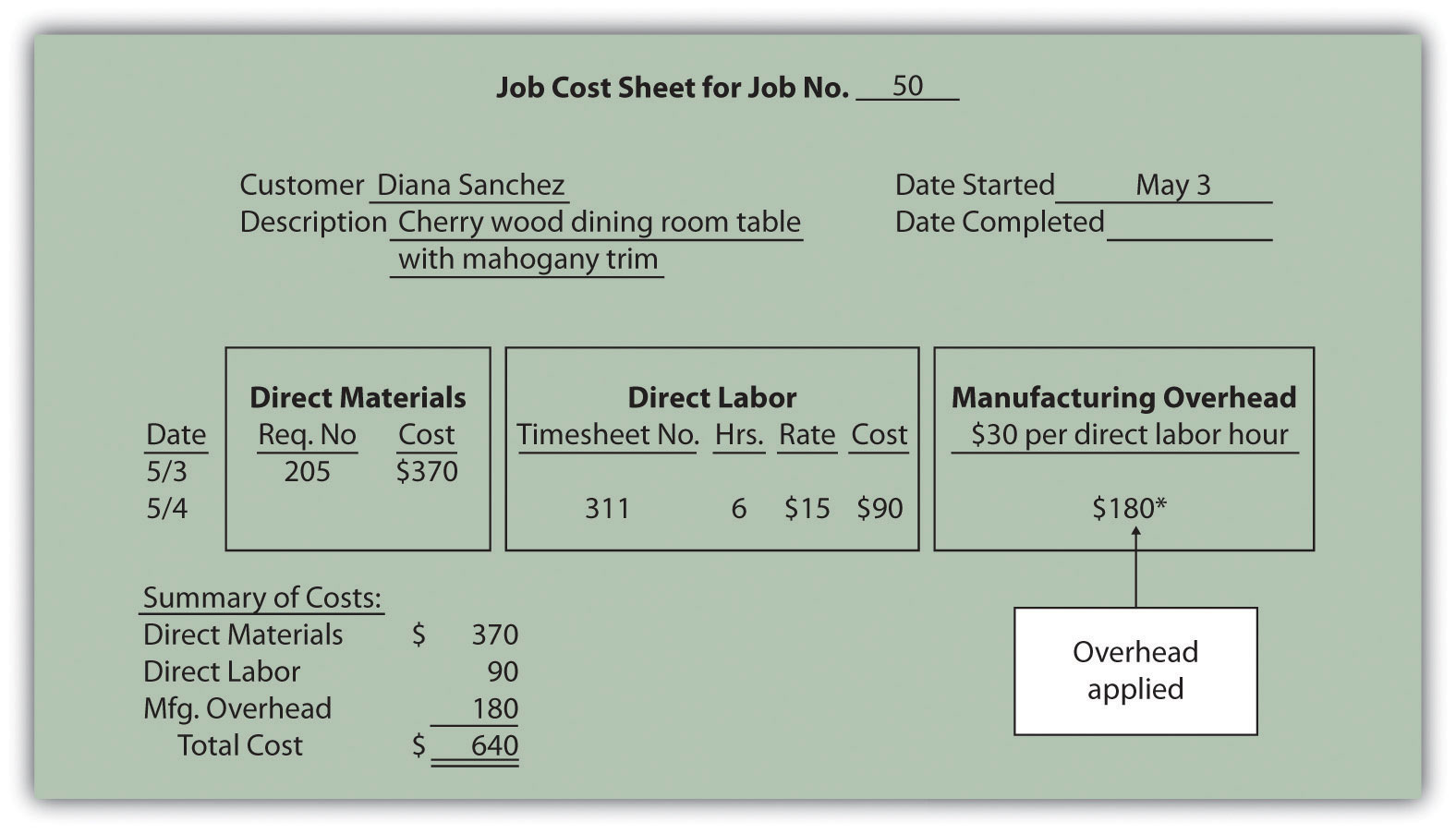

When this journal entry is recorded, we besides record overhead practical on the appropriate chore cost sheet, just equally we did with direct materials and directly labor. Figure 2.6 "Overhead Applied for Custom Article of furniture Company's Job 50" shows the manufacturing overhead applied based on the half dozen hours worked by Tim Wallace. Notice that total manufacturing costs as of May 4 for job fifty are summarized at the bottom of the job cost sheet.

Figure 2.half-dozen Overhead Practical for Custom Furniture Company's Job fifty

*$180 = $30 per directly labor 60 minutes × 6 direct labor hours.

Selecting an Allotment Base

Question: Although nosotros used straight labor hours equally the allocation base for Custom Furniture Company'south predetermined overhead rate, organizations apply various other types of allotment bases. The most mutual allocation bases are direct labor hours, straight labor costs, and machine hours. What factors do companies consider when deciding on an allotment base?

Answer: Companies typically look at the following two items when determining which allocation base of operations to use:

-

Link to overhead costs. The goal is to find an allocation base that drives overhead costs, frequently chosen a price driverThe resource allotment base of operations that drives overhead costs. . For example, if a company's production procedure is labor intensive (i.due east., it requires a large labor force), overhead costs are likely driven by straight labor hours or direct labor costs. The more direct labor hours worked, the higher the overhead costs incurred. Thus direct labor hours or directly labor costs would be used as the allocation base.

If a company'south product procedure is highly mechanized (i.eastward., it relies on machinery more than on labor), overhead costs are likely driven by automobile hours. The more machine hours used, the higher the overhead costs incurred. Thus machine hours would exist used as the allocation base of operations.

Information technology may make more sense to use several allocation bases and several overhead rates to allocate overhead to jobs. This approach, called activity-based costing, is discussed in depth in Affiliate 3 "How Does an Arrangement Utilize Activity-Based Costing to Allocate Overhead Costs?".

- Ease of measurement. An allotment base should non simply be linked to overhead costs; information technology should too exist measurable. The three about common allotment bases—direct labor hours, direct labor costs, and automobile hours—are relatively easy to measure. Direct labor hours and directly labor costs can exist measured by using a timesheet, as discussed before, and then using either of these as a base for allocating overhead is quite simple. Machine hours can likewise be hands measured by placing an hour meter on each machine if one does not already exist.

Why Use a Predetermined Overhead Rate?

Question: The apply of a predetermined overhead rate rather than actual information to apply overhead to jobs is chosen normal costingA method of costing that uses a predetermined overhead charge per unit to apply overhead to jobs. . Most companies prefer normal costing over assigning actual overhead costs to jobs. Why practice well-nigh companies prefer to use normal costing?

Answer: Companies use normal costing for several reasons:

- Actual overhead costs can fluctuate from month to month, causing high amounts of overhead to exist charged to jobs during high-toll periods. For case, utility costs might exist college during cold winter months and hot summer months than in the fall and jump seasons. Maintenance costs might be higher during tedious periods. Normal costing averages these costs out over the course of a yr.

- Bodily overhead cost data are typically only available at the end of the month, quarter, or year. Managers prefer to know the toll of a chore when it is completed—and in some cases during production—rather than waiting until the stop of the menses.

- The cost charged to customers is often negotiated based on cost. A predetermined overhead rate is helpful when estimating costs.

- Bookkeeping is simplified by using a predetermined overhead charge per unit. Ane rate is used to record overhead costs rather than tabulating bodily overhead costs at the end of the reporting period and going back to assign the costs to jobs.

Using a Manufacturing Overhead Business relationship

Question: Using a predetermined overhead charge per unit to apply overhead costs to jobs requires the utilise of a manufacturing overhead account. How is the manufacturing overhead business relationship used to tape transactions?

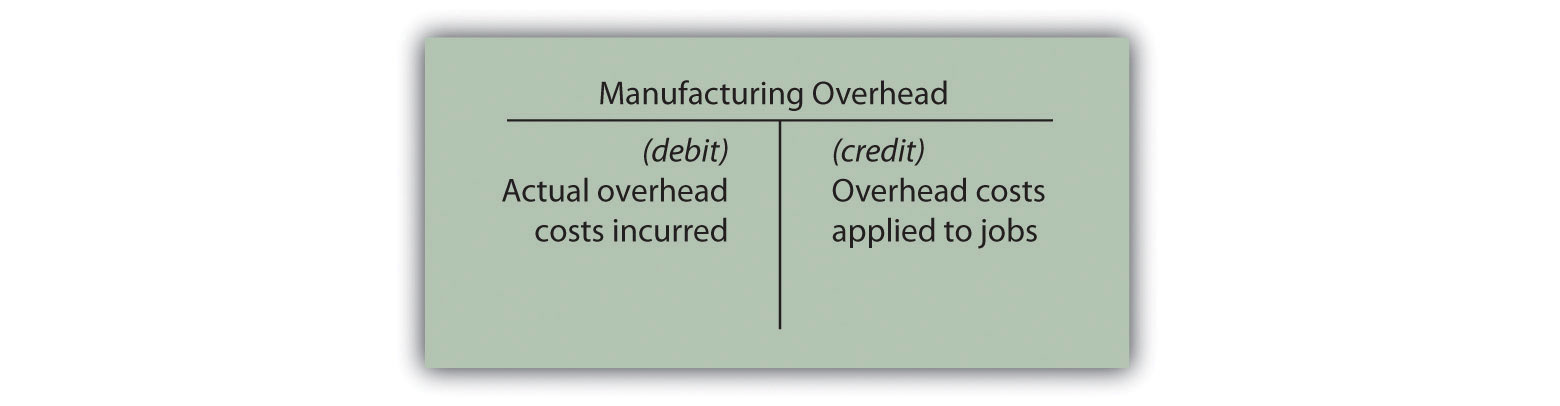

Answer: The manufacturing overhead business relationship tracks the following two pieces of data:

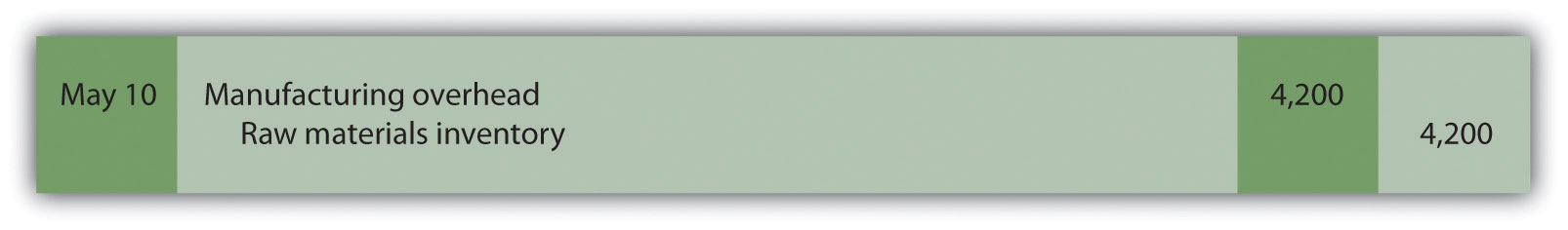

Start, the manufacturing overhead business relationship tracks actual overhead costs incurred. Recall that manufacturing overhead costs include all production costs other than direct labor and direct materials. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead business relationship. For example, presume Custom Piece of furniture Company places $4,200 in indirect materials into production on May 10. The journal entry to reverberate this is as follows:

Other examples of actual manufacturing overhead costs include factory utilities, car maintenance, and manufactory supervisor salaries. All these costs are recorded every bit debits in the manufacturing overhead account when incurred.

2nd, the manufacturing overhead business relationship tracks overhead costs applied to jobs. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. You lot saw an case of this before when $180 in overhead was applied to job 50 for Custom Furniture Company. Nosotros repeat the entry here.

The post-obit T-account summarizes how overhead costs flow through the manufacturing overhead business relationship:

The manufacturing overhead account is classified as a clearing accountAn account used to hold fiscal data temporarily until it is closed out at the cease of the period. . A clearing account is used to concord fiscal information temporarily and is closed out at the end of the flow earlier preparing financial statements.

Underapplied and Overapplied Overhead

Question: Because manufacturing overhead costs are applied to jobs based on an estimated predetermined overhead rate, overhead applied (credit side of manufacturing overhead) rarely equals actual overhead costs incurred (debit side of manufacturing overhead). What terms are used to draw the difference betwixt actual overhead costs incurred during a period and overhead applied during a period?

Answer: Two terms are used to describe this difference—underapplied overhead and overapplied overhead.

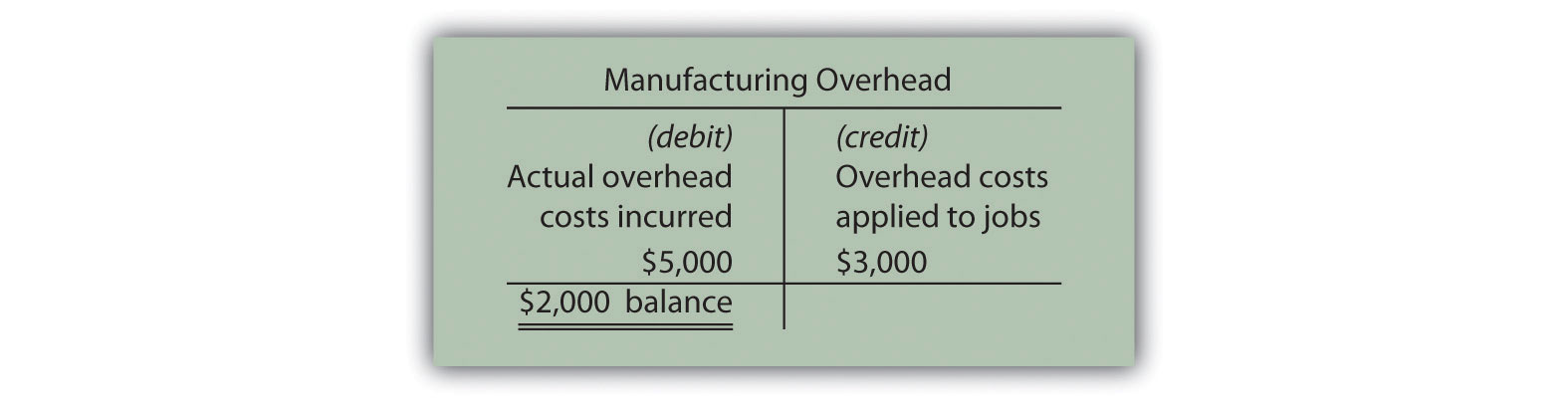

Underapplied overheadOverhead costs applied to jobs that are less than actual overhead costs. occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). The T-account that follows provides an example of underapplied overhead. Note that the manufacturing overhead business relationship has a debit residue when overhead is underapplied because fewer costs were applied to jobs than were actually incurred.

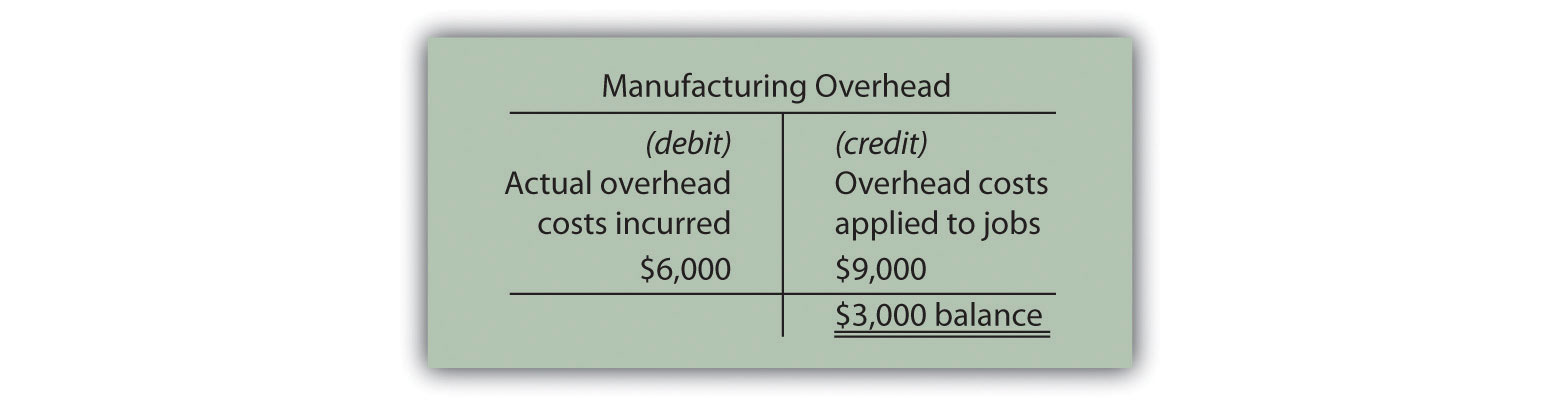

Overapplied overheadOverhead costs applied to jobs that exceed actual overhead costs. occurs when actual overhead costs (debits) are lower than overhead applied to jobs (credits). The T-account that follows provides an example of overapplied overhead. Note that the manufacturing overhead business relationship has a credit balance when overhead is overapplied because more costs were applied to jobs than were really incurred.

Business concern in Action 2.1

Task Costing at Boeing

Boeing Company is the world's leading aerospace company and the largest manufacturer of commercial jetliners and military shipping combined. Boeing provides products and services to customers in 150 countries and employs 165,000 people throughout the world.

Since most of Boeing's products are unique and costly, the company likely uses chore costing to track costs associated with each production it manufactures. For example, the costly direct materials that go into each jetliner produced are tracked using a chore cost canvas. Direct labor and manufacturing overhead costs (think huge production facilities!) are also assigned to each jetliner. This careful tracking of production costs for each jetliner provides management with important price information that is used to assess production efficiency and profitability. Direction can answer questions, such as "How much did straight materials cost?," "How much overhead was allocated to each jetliner?," or "What was the total production cost for each jetliner?" This is of import information when information technology comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines.

Closing the Manufacturing Overhead Account

Question: Since the manufacturing overhead account is a clearing account, it must exist closed at the end of the catamenia. How do nosotros shut the manufacturing overhead business relationship?

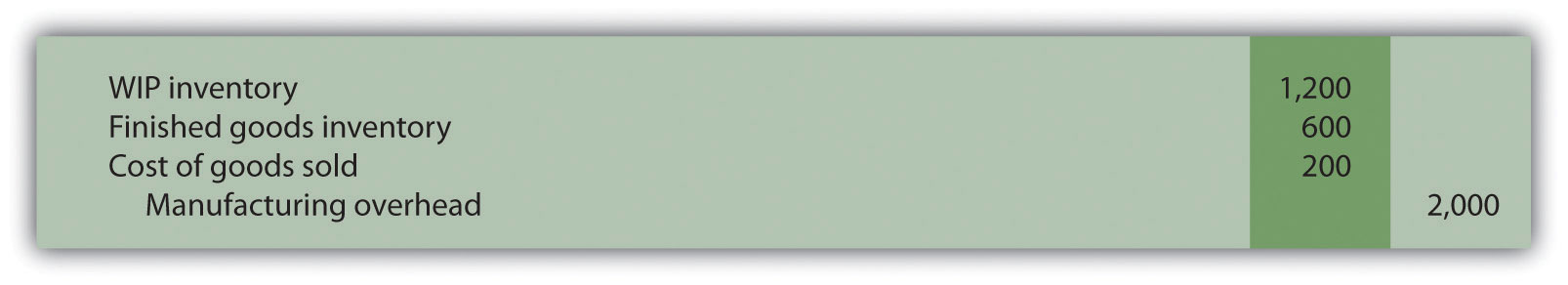

Answer: Almost companies simply shut the manufacturing overhead account residue to the cost of appurtenances sold account. For example, if there is a $2,000 debit residual in manufacturing overhead at the end of the flow, the journal entry to shut the underapplied overhead is as follows:

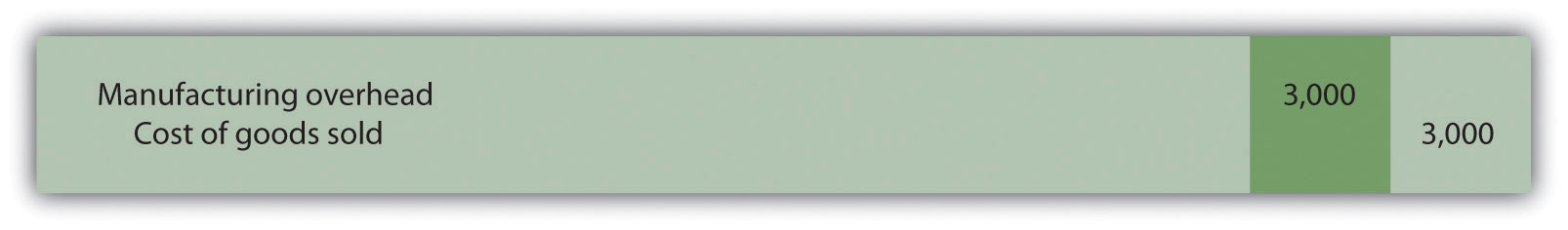

If manufacturing overhead has a $3,000 credit remainder at the terminate of the period, the journal entry to shut the overapplied overhead is as follows:

Alternative Approach to Closing the Manufacturing Overhead Business relationship

Question: Although most companies shut the manufacturing overhead account to cost of goods sold, this is typically just done when the corporeality is immaterial (immaterial is a common bookkeeping term used to describe an corporeality that is pocket-size relative to a company's size). The term material describes a relatively large corporeality. How do nosotros close the manufacturing overhead account when the corporeality is material?

Reply: If the amount is cloth, information technology should be closed to three different accounts—work-in-process (WIP) inventory, finished goods inventory, and toll of appurtenances sold—in proportion to the account balances in these accounts.

For example, suppose a company has $2,000 in underapplied overhead (debit balance in manufacturing overhead) and that the three account balances are as follows:

The $2,000 is closed to each of the three accounts based on their respective percentages. Thus $one,200 is apportioned to WIP inventory (= $two,000 × threescore percentage), $600 goes to finished goods inventory (= $ii,000 × 30 per centum), and $200 goes to toll of appurtenances sold (= $2,000 × x per centum). The journal entry to close the $2,000 underapplied overhead debit rest in manufacturing overhead is as follows:

Although this approach is not as common as only closing the manufacturing overhead account balance to price of goods sold, companies do this when the amount is relatively significant.

Key Takeaways

-

Most companies utilize a normal costing system to track product costs. Normal costing tracks actual straight material costs and bodily direct labor costs for each job and charges manufacturing overhead to jobs using a predetermined overhead charge per unit. The predetermined overhead charge per unit is calculated as follows:

- A manufacturing overhead account is used to track bodily overhead costs (debits) and applied overhead (credits). This business relationship is typically closed to price of goods sold at the end of the period.

Review Problem ii.3

- Chan Company estimates that annual manufacturing overhead costs volition be $500,000. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 automobile hours volition be required for the yr. Calculate the predetermined overhead rate.

- Why might Chan Company use machine hours as the overhead allotment base?

- Chan Company received a bill totaling $3,700 for auto parts used in maintaining manufacturing plant equipment. The bill volition be paid side by side month. Make the journal entry to record this transaction.

- Task 153 used a total of 2,000 machine hours. Make the periodical entry to record manufacturing overhead applied to job 153. What other document volition include this corporeality?

-

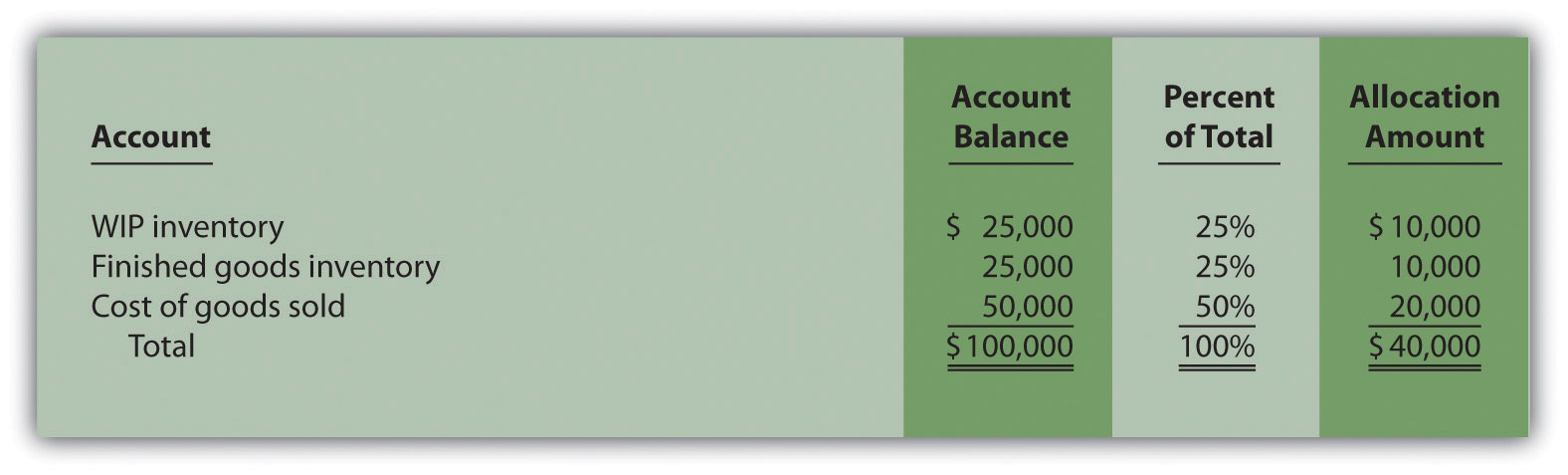

Presume Chan Company incurs actual manufacturing overhead costs of $470,000 and applies overhead of $510,000 for the yr. Account balances are as follows: WIP inventory, $25,000; finished goods inventory, $25,000; and cost of goods sold, $50,000.

- Is overhead overapplied or underapplied? Explicate your answer.

- Make the periodical entry to close the manufacturing overhead account bold the balance is immaterial.

- Make the journal entry to shut the manufacturing overhead account assuming the balance is material.

Solutions to Review Trouble ii.3

-

The predetermined overhead rate is calculated as follows:

-

If Chan's production process is highly mechanized, overhead costs are likely driven by machine use. The more than auto hours used, the higher the overhead costs incurred. Thus there is a link between machine hours and overhead costs, and using machine hours as an allocation base is preferable.

Motorcar hours are likewise easily tracked, making implementation relatively uncomplicated.

-

-

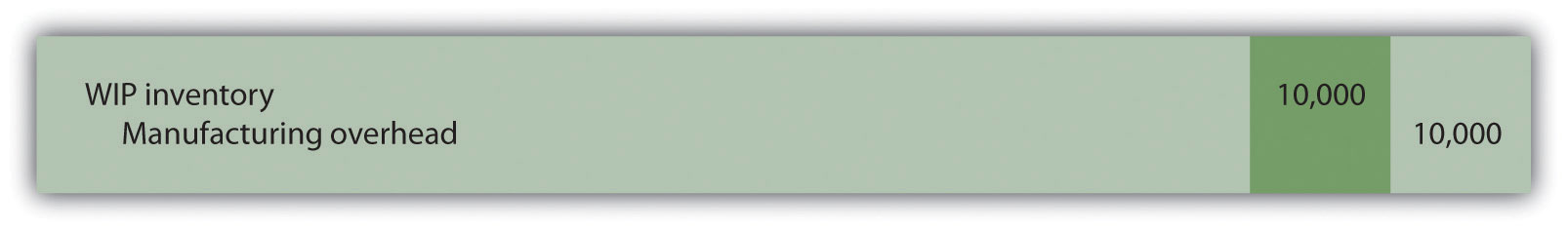

A total of $10,000 (= $5 per car hr charge per unit × ii,000 machine hours) will be practical to job 153 and recorded in the journal as follows:

This amount will also be recorded on the task cost sheet for Job 153.

-

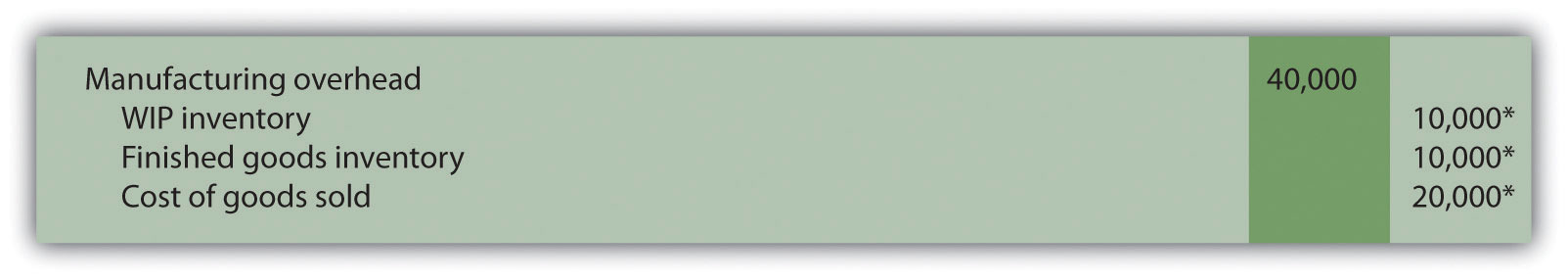

- Overhead is overapplied because actual overhead costs are lower than overhead practical to jobs. Also, the manufacturing overhead account has a credit balance.

-

-

*Amounts are calculated as follows. Allocation corporeality = percent of total × the overapplied residue of $40,000.

Source: https://saylordotorg.github.io/text_managerial-accounting/s06-03-assigning-manufacturing-overhe.html

Posted by: paulinoalonese.blogspot.com

0 Response to "How To Find Direct Labor And Manufacturing Overhead Applied"

Post a Comment